My Life as a Pig

|

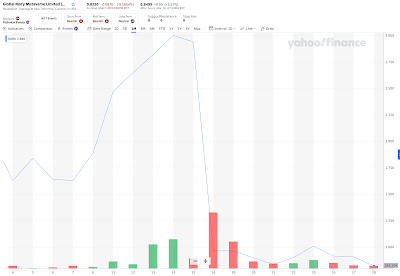

| The pig butchering operation on LXEH shown by the share price and volume on March 21st, 2024 |

I'll cut to the end first, and then explain: In the end, I was not butchered, not this time, anyway. But I saw it happen to others in real time.

How My Experience Began

Around January 16th, I saw an ad on Facebook. In it was a picture of Bill Ackman and his wife, and a caption describing some investment club that Ackman was heading up. Ackman is not only a fabulously wealthy hedge fund manager, he's also very active on X, where his very public efforts helped bring down the presidents of both the University of Pennsylvania and Harvard University last fall. While I wasn't terribly fond of his tactics in those efforts, I respected his results with Pershing Capital well enough and figured this might just be the sort of thing he'd do. Anyway, I figured I had nothing to lose by clicking the link.

|

| The Facebook ad |

"Today we are going to start sharing in this group again because we have a lot of new investors joining, so I am going to introduce some information about our company once again, this group was co-founded by Chris Brown and Bill Ackman, we are from Wisdom Capital Management Ltd because we believe that 2024 is going to be a positive year for the global financial industry will be a positive year for the global financial industry, so we are doing some advertisements on Google and FACEBOOK in order to reach more investors and increase the visibility of our company, if you are a real investor then please stay here and wait for the hot investment advice that we are sharing today, maybe you have a lot of questions at the moment but give us three days and we will prove the value of our company by sharing professional content to prove the value of our company and prove that working with us will be a right choice, here is the administrator account for this group, if you have any questions, you can ask by private message."

Yes, that was all one sentence, and it should have been an immediate red flag, but I let it pass. It referenced Mr. Ackman and seemed to be in line with the Facebook ad, so I played along. The "administrator account" information was posted, the name was "Elena Ross." A few moments later, another Group Management" note, coming from the phone number listed for Elena, was posted:

"Wisdom Capital Management Ltd was co-founded by Chris Brown and Jasper Lim, our team of advisors have a proven investment approach, we are committed to serving each and every investor, so we have developed a break from the traditional service approach to investment consulting, we are keen to serve each and every signing up for VIP members to carry out exclusive services, targeted at solving the investor's own questions and annual return on investment."

Notwithstanding that two different accountings were given as to who co-founded the group in just 7 minutes, I didn't flee. Ten minutes later, a third long sentence was posted:

"Today in order to welcome every new investor, the professional investment team from Wisdom Capital Management Ltd. will share the high quality hot stock code for you, this will be a short term trading program, the expected return can reach 8%-12%, because there are many new investors come here, so we need to know every investment and Share investment advice, so for the time being, we will not send the trading code to the group, please add the business card below to receive the recommendation of today's popular U.S. stocks by private message, today's sharing is completely free, if you want to know whether the investment shared by our company is professional, you can try to privately mail the administrator's business card to get the information and wait and see, it will not have any effect on you."

Still, I didn't flee. Over the next hour or so, Elena posted the following as a statement as to who Wisdom Capital were and what our engagement with them would be:

- We, Wisdom Capital Management Ltd. mainly provide investment market strategies and practical management processes to help create first-class solutions for the company's customers, at present, our company has served 12,000 investment users, contracted to cooperate with the size of the amount of 250 million U.S. dollars, our company does not allow trading on behalf of the customer, so we are entirely through the online We do not allow trading on behalf of clients, so we share investment advice entirely online, and all investors execute transactions in accordance with the specified recommendations, and the total annual return on investment for contracted VIP users can reach between 300% and 500%.

- At present, all new investors are free to experience our VIP services, free time limit of 100 days, in the VIP experience time after the deadline, each investor must be contracted with our company to continue to enjoy our investment services, to reach a contract to cooperate with the conditions of the need to pay 2% -5% of the profit after tax as a commission of the cost of cooperation, at the end of each month, with the financial department of the Department of the Division I docking liquidation!

Elena also posted a link to the firm's website, as well as to a link to its SEC filing. Both the website and the SEC filing were real; had I read the details of the SEC filing I might have caught on right away, but I didn't.

Someone in the chat asked, "What if the stock goes down?" The reply came just four minutes later:

"Although we can not guarantee 100% profit, but through our multiple investment advisors jointly designed AI intelligent stock selection technology screening stock winning rate can reach more than 80%, so you have to strictly adhere to the trading recommendations we give, if within the specified recommendations, then we will also compensate you for the loss of 50% of the amount, our quantitative trading team to pursue a stable income, rather than a short-lived success, so please rest assured that we pay more attention to the company's reputation, we will be responsible for every investment advice shared, if you have not picked up today's hot U.S. stock recommendations, please click the business card below and contact Elena Ross, Investment Assistant, to get trading information."

This really seemed too good to be true, another red flag. But I still didn't flee.

The Next Day

I only noticed the next day, January 17th, that in order to receive the stock picks, I had to contact Elena individually. So I made contact and asked for the stock symbols for the day. I received a series of responses:

At 8:58am: Well, once the U.S. stock market starts trading, I'll share with you the day's hot ticker symbols, so you'll need to stay in touch with me to make sure you can get in on the action at the best possible price!

At 9:23am: Good morning, today's hot stock symbols have been confirmed, do you have time to receive the stock symbols?

Then, after I confirmed, at 9:35am:

Strong Trading Strategy for January 17th

Ticker: ACMR

Buy Price: $20.00-$21.00

Expected Return: 8%-10

Reason to buy: The stock recently in the semiconductor sector, always along the semiannual line climbing, last Friday the stock price hit a new stage high, yesterday stepped back on the 5-day average. Weekly level to see last week's volume rose to break through multiple obstacles, long momentum to continue to power, is expected to continue to climb along the uptrend line in the short term

Besides that the stock was a bit below the "buy price" range, this all seemed reasonable enough, despite the poor writing in the rationale. It looked more or less like something I might see at The Motley Fool. I checked ACMR, saw that it was a mid-cap with plenty of volume, and bought some shares at $19.35. No worse than anything else, I thought, and anyway I had enough spare cash to do it. Elena sent another message:

"Once your purchase is complete, please send me a screenshot of your order, I will need to track the order for you and notify you of any status!"

This seemed silly, but I did it.

Getting to Know Me

Elena seemed very interested in getting to know me personally. Elena sent the following message: "Can I know more about your investments to better help you profit in the stock market?"

In broad strokes, I replied and gave a 3 sentence overview. Within a couple more questions Elena had already moved on to the point of the matter:

"I just want to understand your investment style based on your portfolio so that I can recommend the best trading program for you. What is the total value of your current investments?"

In order to be even more helpful, Elena also sent this:

"If you are not satisfied with your current returns, please send me a screenshot of your portfolio and I will have one of the CFA financial analysts at our organization run a diagnostic that I hope will help you"

At this point, they had me all in. I replied, "ok, that sounds good. Is that also covered as part of the trial run? I’m not happy with my Schwab portfolio. According to metrics from Fidelity, the 401k’s are fine but still trail S&P by several points. wrt picks such as AMCR — do I send you messages for those each day, or will you be announcing them automatically now?"

Even on this first full day, I noticed the seemingly inordinate amount of personal attention I was receiving. Far from being comforting, I found it unsettling. I asked: "How many people joined from the FB ad, and how do you have time for all?" Elena's reply, which I eventually discovered to be accurate, though perhaps a bit misleading:

"I can't take care of everyone at the same time, but I'm not the only assistant in our organization. My job is only to help new investors, and VIP members who have already established cooperation with our organization will be taken care of by another assistant"

The next morning, Elena had another pick:

Strong trading strategy for 1.18

Ticker: MARA

Buy Price: $16.50-$18.00

Expected Returns: 8%-10

Reason to buy: After the approval of the Bitcoin Spot ETF, the market's expected favorable landing, in line with the buy the rumor, sell the news principle, Bitcoin and related concept stocks ushered in a sharp pullback. The stock retraced from the highs to the support area, with the cryptocurrency gradually get more widely recognized and applied in the market, its market value will be gradually found, the current unfaltering chips have left the market, the short term will pull up again

I bought at $17,25, Again, I had to send a screen shot. MARA immediately went down, and then Elena sent another message:

"Don't worry, MARA is a short term trade and we will take profit in the shortest possible time, this will not affect the liquidity of your funds. So you need to buy more MARA as soon as possible at the market price"

This seemed to me an interesting take on dollar cost averaging, so I bought more at $16.15. For the moment, at least, I was enjoying this. I started chatting happily with Elena about how unhappy I was with my portfolio. Dollar signs flashed in my brain.

The next day's recommendation:

Strong Trading Strategy for January 19th

Ticker: LYFT

Buy Price: $12.50-$13.00

Expected Return: 8%-10

Reason to buy: The company's overall revenue and earnings levels have steadily improved, and free cash flow levels have improved significantly. Technical analysis shows that the stock has reached a strong support zone after pulling back from its highs, and relative to peer UBER's recent strong gains, the stock is expected to see a catch-up market, and can now be entered early and held for gains

I post these here for a reason, keeping in mind these were the first three stock picks I received, in a period of about 72 hours:

- ACMR went up 75% by March 1st.

- MARA went up 92% by February 28th.

- LYFT went up 61% by March 21st.

Any stock picker would love returns like that over a full year or more. Expecting those returns over a period of a few weeks, by design, would be insane. They really seemed good!

For some time after I understood this to be a scam, I tried to guess as which real Stock Service Wisdom Capital might be poaching for its stock picks. Finally their pick of VSCO (Victoria's Secret) on February 21st, shortly before it lost 35% of its value, removed my last bits of doubt that they were somehow stock picking geniuses in addition to being scammers.

On January 19th, Elena sent me the following message:

"Good, it looks like you fit our organization's investment philosophy very well. Also, next Monday we will be announcing a specific trade in a short term high return stock in our VIP group, we expect to make a 15%-20% profit in just 2 business days, and I'll let you know in advance so you'll know enough about the trade"

I was promoted to the "VIP Group."

Suspicions

It didn't take long for me to become suspicious of the operation. I figured I needed to know the operation a bit better, so as long as Elena was chatting with me, I'd ask some questions. On the same day as the LYFT trade, I asked Elena some questions:

"Question: what is the connection between Wisdom Capital and Pershing and/or Bill Ackman"

Within two minutes, Elena responded: "Bill Ackerman is a partner in our firm, currently managed by Mr. Brown and Mr. Lin. However, Bill Ackerman is involved in all of the transactions we recommend"

This was immediately troubling. Elena misspelled Ackman's name, twice. I tested it:

"I thought it was Bill Ackman? That’s a typo above? I do not know any Bill Ackerman."

Elena's reply: "That was a serious mistake I made. It was Bill Ackerman."

Now it was no longer a simple spelling error. I persisted: "You wrote Ackerman again?" My intent being to point out that Elena had written "Ackerman" instead of "Ackman" in the chat. Elena's reply:

"Yes, but I usually write Mr. Ackerman very little unless it's important work"

In order to keep this from slipping in to an Abbott and Costello routine, I asked:

"Is it Ackman, of Pershing Capital, or Ackerman? If it is Ackerman, I'd like to know who Ackerman is. I know who Ackman is."

This time, Elena answered, "I was referring to Mr. Ackman of Pershing Capital." Elena then added, "He is one of our agency's collaborators, but currently our agency is run by Mr. Brown and Mr. Lim," contradicting again the statement of Ackman being a founder. Elena then added, "it's a grammatical error on my part and I apologize for that 😜," apparently not grasping the difference between grammar and spelling.

A few hours later, Elena volunteered information that I was not expecting:

"Assistant is not my only job, I opened a restaurant because I like to cook myself. I would like to welcome you to my restaurant sometime😊"

I asked where and got this reply:

"150 South Street, Morristown

It's called Sterling's Tavern"

"New Jersey?," I asked. Elena confirmed within one minute, and added 3 minutes after that, "You don't seem to want to come to my restaurant?"

This was, in a word, bizarre.

Not only was I to believe Elena was a real "assistant" for a real brokerage handling investments for many people, but that Elena also owned a restaurant in New Jersey just a few miles from where I grew up? I quickly googled and saw that, yes, there was a real restaurant called Stirling Tavern at 150 South Street in Morristown. But it's "Stirling," not "Sterling's." As it happened, I had been to Stirling Tavern's sister restaurant, "Stirling Inn," just a few months prior, so I was familiar with both the spelling and even the history. I let Elena know that my hometown was neatby and that I would be happy to visit on my next trip to New Jersey.

I checked the bio for Elena on the website. In addition to the Stirling Tavern reference, it also said that Elena had a Business Administration degree from the University of Southern California. Having a degree from USC myself, I decided to get access to the alumni directory to confirm this tidbit.

On the 21st, being sufficiently troubled by the questionable bio and behaviors, everything from misspelling Ackman's name to misspelling the name of the Tavern and requiring screen shots of trades to the inordinate amount of personal attention, I emailed my friend Mark and asked, "what would you recommend? Flee for the hills? Stick around 100 days and find out? Give them a shot at recommending a re-org of my portfolio? What red flags am I missing?"

Mark's response was fast and decisive: "it's a total scam, and of a particularly classic variety."

But, though Mark had tagged it immediately, I couldn't yet identify what the scam was. After all, I was trading real mid-cap and large-cap stocks with my own brokerage account. The stocks were going up, even. Where was the scam, and how could I even prove it to myself?

Mark quickly identified that this was a pig butchering scam, and found prior versions of it going under names such as "Red Sea Fortune Investment." He also found obvious gaps in Wisdom Capital's SEC forms, e.g., that their listing dated back only the December 13th, 2023, and also spotted some persistently misused terms and words, the sorts of things that would come from poor usage of language translation applications.

Within a few days, I was able to confirm that the University of Southern Califormia had no records of Elena Ross -- nor, for that matter, of anyone named Elena with a business degree in her claimed graduation year and I was also able to confirm that The Stirling Tavern had no idea their establishment's name had been used by Wisdom Capital, let alone any idea of who Elena Ross was. Elena helped out here as well with a bit of a self-own: When I mentioned that I had been to Stirling Inn, Elena wrote, "A tavern and a hotel are different concepts." The Stirling Inn is a tavern. Using another of Mark's suggestions - to reverse search user images - I was able to find many fake id's on my chat board, even the main image on the "Wisdom Capital" website was pilfered from an artist's website.

I started to turn off the greed instinct, and switch to information gathering.

The VIP Group

On my first morning in the VIP group, "Group Management" posted the following:

Trade Announcement:

Our short term high return trade has been confirmed and tonight we will bring our member users who have already cooperated to participate in VIP International Stock. It belongs to the Hong Kong stock market, the stock code is: [6118 Austar Lifesciences Limited] and we expect that the profit can reach 15%-30% by holding it for 2 business days. Since this trade is for member users who have already cooperated, the share of the trade is limited. All new investors can keep watching: 6118's performance, but do not trade high to avoid unnecessary losses!

This was the first scam tip-off -- trading on the Hong Kong market. The VIP room seemed much smaller than the prior group. They were separating me from other investors.

Elena gave me more stock tips: AAL, AI, PLTR. All of them went up, sharply. Again, any stock picker would be thrilled with the returns. The AAL (American Arlines) recommendation came with the following rationale:

"Reasons to buy: the stock belongs to the local aviation sector, due to the continuous decline in demand within the industry, so the stock price has also seen a long-term downtrend, the bank currently expects the demand for air passenger transportation will pick up again in the Spring Festival next year, the passenger volume is expected to exceed the same period of 2019; next year, supply and demand for overseas routes is expected to be fully restored, the profit structure of the airline company will return to the norm, and the airport's profitability will continue to recover."

Having no idea what was meant by "the Spring Festival," I turned to Google. It's a reference to Chinese New Year.

In each case, though, Wisdom Capital made "profit taking" calls with profits of nominal amounts. For example, LYFT was sold at a 4% profit. After I sold AAL, Elena asked: "Okay, Matt did you calculate how much profit you made at AAL?" When I confirmed, Elena wrote:

"Haha, then I'm sure you've seen the strength of our organization, you're putting in too little money right now so you're not making much, I'd suggest you increase your capital on your next trade so you can maximize your profits"

Elena then added:

"Today we successfully sold VIP International shares [6118 Austar Lifesciences Limited] at a price of HK$2.20, gaining 14.58% in just 2 working days. Another VIP International stock we will trade next week can also earn good returns in the short term. I will notify you as soon as the specific trading time is confirmed."

By now the scam was becoming obvious: Wisdom Capital separated "pigs" to separate VIP rooms, where they'd be separated and fattened up, and eventually Wisdom Capital would "butcher the pigs" with some micro-cap stock on the Hong Kong market. Stocks like 6618 were used as part of the "fattening" stage of the scam, to get investors comfortable with international trading in large dollar amounts.

Active participants in the VIP chat group were entirely - or nearly entirely - participants in the scam. In some cases I was able to identify scammers by reverse lookups of their profile pictures; if a picture that was being shown as one id in the chat room was showing up under some different name in a reverse lookup, e.g., from a corporate website or Facebook, then the user was fake. I couldn't find any for-sure "real" people at all in my chat room, not even one.

Red Sea Fortune Investment

Mark pointed be to a facebook group and an associated page for "Red Sea Fortune Investment," a prior iteration of "Wisdom Capital Management," just with different names: "Ava Evans," for example, instead of "Elena Ross." At the end of 2023, Red Sea Fortune Investment had run its pig butchering scam on Hong Kong issues, and by my back of the napkin calculation had likely cleared more than $100 million in scam proceeds from its victims.

Some of the victims had gotten together to form a Facebook group and start off a reddit page, with the hopes of organizing and also warning off future potential victims. I wasn't eligible for the Facebook group, since I wasn't a victim of that scam. But I joined the open forum reddit, and one user quickly spun off a sub-page specifically for Wisdom Capital Management, in the hope of warning off potential victims.

Phone Calls, Pictures from Elena, and Natasa

On January 25th, a VIP participant wrote via IM: "Hi, I'm Natasa and we're from the same group." Natasa continued, "Did you buy any of the stocks they recommended? I bought 4 and have made profits in 3 stocks so far, but I've lost some money on MARA so far, how about you?" Natasa seemed concerned: "So far I'm at a loss, so that's why I added you." Natasa added, "You're the second person I've contacted, but I think we should always be in touch."

I reverse looked up the image of Natasa, and despite the Columbus Ohio phone number attached to the account, I found an instagram account in Eastern Europe, with a different name. "Natasa" was part of the scam.

On January 26th, Wisdom Capital put out a "profit taking" call for MARA at $17.80. When I didn't immediately respond, my phone rang with an incoming call from Elena Ross. I rejected the call.

On February 5th, Wisdom Capital made a buy call on PLTR, an AI stock. Still playing along at least with the US stock picks, I bought at $16.875. After the market closed, Elena wrote: "Our recommended PLTR has gone up after the bell, looks like you've been busy"

I answered, "We will see what happens tomorrow!"

Elena persisted: "Aren't you afraid of a stock pullback?"

After selling the next morning, Elena demanded a screen shot of the sale. I responded, "Shouldn't hugely be necessary for sales. Profit was nice for PLTR but sold way early." Elena responded:

"I understand where you're coming from, what our organization needs to make sure is that every investor is able to make a profit, and we won't be the last to sell"

These attitudes, of course, are key to the butchering scheme. Elena then asked:

"Are you paying attention to the information our group is sharing, we bought VIP stock 918 at 0.54 last Friday, today we have successfully sold it at 0.63HKD, this time the VIP stock has allowed investors to make a profit of up to 16.67% in two trading days, do you know why 918 went up so well?"

Elena also sent a picture with a breakfast spread and said, "I'm having a cup of coffee right now. Do you like coffee?" I quickly determined that the picture was taken in a well-known company. Bacha Coffee, based in Singapore. I couldn't find the precise picture in a reverse search. Nor could I figure why someone pretending to run a restaurant in New Jersey would send a picture so easily traceable to an establishment that does not exist in the United States. As with any magic trick, though, once I knew the ruse, it became much easier to spot the flaws.

The Reddit Group

The Reddit group allowed real people to gather together and discuss -- something what the Wisdom Capital WhatsApp group sought to prevent on its WhatsApp chat boards.

We learned the following:

- there are many WhatsApp VIP groups

- each VIP group has its own version of "Elena Ross," with a different contact number. "Elena Ross," in each group, may be played by many people, thus allowing the impression that Elena is always there. The quality of the English writing I might receive would vary widely, depending on who was playing the role of Elena for me at that moment.

- each VIP group also has its own version of "Natasa"; as with Elena, played by multiple people.

- each VIP group is populated entirely, or nearly entirely, by participants in the scam

- the names of the scammer participants in each chat room are different, but the script is pretty much identical

|

| The warning page from Temasek |

The script was to have plenty of discussion praising the wisdom of Chris Brown and Jasper Lim -- often with stilted references to "Brown" or "Mr. Lim." There were "training" sessions with discussions on various trading features; these were largely rudimentary and/or incompetent, presented with synthesized voices over youtube and then quickly deleted.

On February 18th, a Sunday, Elena put out a notice:

"Good Morning, MattOur VIP stock has been set to start trading tomorrow morning at 8:30 am EST, this trade we expect to hold 1-2 business days, you can get 10%-20% profit🥳🥳🥳🎉🎉🎉

So I'm telling you in advance, you remember to keep in touch with me tomorrow morning, I will notify you of the specific purchase information

Have a good weekend"

When I responded with "Ok," a few moments later, Elena followed up:

"If you have bought 2477 at the stock price notified by our organization, you can place a pending order early tonight at the market price to avoid the risks associated with market unknowns "

The Chinese brokerage Moomoo stepped in and canceled all pending orders for 02477.

Whether they picked up signals that the trades were not "legitimate," remains unknow.

The Fake Trade

After many participants chimed in with something along the lines of, "I joined here two weeks ago and haven't seen any investment advice on VERA," the original poster offered this: "I purchased it at $21.50 and at this point can anyone help me with whether I need to sell or not!" At the time, VERA was selling for $47.99 per share.

One participant responded, "Don't give away any information about value investing stocks. FUCK! 😡😡"

The original posted responded, "Badly, I realized that I had leaked the Pioneer 4 Value Investing trading plan, violating Mr. Brown's customized trading rules, which he asked everyone to keep secret."

More "heated" responses followed: "Damn, you leaked the code for value investing, which could affect our trading program 😤😤" "Mr. Brown please remove this deal breaking idiot from the group chat, he broke the rules of the deal that was made"

Finally, Chris Brown chimed in: "Everyone needs to stay calm, please don't curse, but you shouldn't reveal the current value investment of "Vanguard 4" that has not been sold yet. VERA's price is still rising, but because you leaked this trading plan early, it may impact our profits. Every value investor should keep it confidential, it's not just for you"

In the reddit group, we saw that virtually identical conversations of the VERA trade that never was, was happening across the VIP chat groups.

In the fall, Red Sea Fortune Investment pulled this stunt with a Hong Kong security. This time they picked a random stock that had doubled over the prior month, and then made it appear that they had secretly picked the stock for "Pioneer 4 Value Investing"; with use of "Pioneer" and Vanguard" seemingly being used interchangeably. That meant "Pioneer 5 Value Investing" was coming soon.

The next day, I received a note from Elena:

"Good news🥳🥳🥳Today, we successfully sold the US stock VERA at $48.93 for a total profit of 127.5%. Although someone leaked trading information about the stock, causing us to sell early, we still made a high return. I'm concerned that you don't understand (Pioneer #4) why VERA went up, so I've put together a document to give you an idea of the exact trading strategy. If you are interested in the trading strategy, please ask a question here and I will answer it for you!"

At this point Elena encouraged me to contact Chris Brown. Elena also offered this:

"I've left a message for Mr. Brown saying you're a good friend of mine, you can add your card to leave a message, Mr. Brown may be busy at the moment, he'll get back to you as soon as he can"

On reddit, we noted that versions of Elena had left nearly identical messages for many would-be investors.

I did not contact Chris Brown, and was soon removed from the VIP chat room; my expectation is that the entire chat room was discontinued, since there were no likely victims in it. Wisdom Capital made the determination that I wasn't going to bite, and stopped trying... at least for me.

NASCO, GMM and LXEH

|

| The pig butchering operation on GMM shown by the share price and volume on Match 18th, 2024. |

On March 13th, Wisdom Capital made a recommendation to buy a stock, GMM, at $2.70 per share. At least, they did this on some of their groups. In others, they gave different timings and prices, and in others besides, they did not give the recommendation. GMM was iniitally listed on NASDAQ in October, 2023, and appeared to have been used for a prior pump-and-dump in December 2023. Typically, GMM had very low volume, and it didn't take much market analysis to determine that there was no demand for it that could sustain a price of $2.70. Wisdom Capital labeled the investment as "Pioneer 5."

On the reddit, participants immediately recognized the red flags, One reddit participant wrote, "this stock is a flaming pile of dog sh!t. I wouldn’t touch it even if I didn’t know about the scam." But we had no way to warn people: Wisdom Capital's method of segregating users meant that the only way we could reach people was for them to find us. Some did: "Thanks for saving my $," wrote one new arrival.

The actual slaughter didn't commence until all the pigs, as it were, had put in their buy orders. The rug was pulled out on March 18th, and within a few moments the share price, which had been at $2.94 at market close on the 15th, was at 85 cents, a fall of more than 70%.

Soon we learned of a second pig butchering operation: another Chinese stock on NASDAQ, LXEH, LXEH was touted in separate Wisdom Capital WhatsApp groups from GMM. Wisdom Capital pushed this stock at $5.89 per share on March 19th. The reddit users wasted little time: "Anyone in LXEH should get out NOW before the bottom drops out," wrote one. But again, we had no way of reaching people. The slaughter was on March 21st, and was far more severe: The share price fell more than 90%.

|

| Facebook keeps the ads |

We believe there is at least one more stock to be used as part of the scheme for "Wisdom Capital," unannounced as of this post and advertised only to WhatsApp groups that didn't previously receive the GMM or LXEH recommendations. Wisdom Capital is also promising a "Pioneer 6" which would make good on the losses of "Pioneer 5"; this too, of course, is a scam.

Worse, we're also seeing additional scammers trying to prey on the victims with promises of "recovery" firms and similar.

I, and several others, reported the Wisdom Capital ads. I collected variants tied to Steve Cohen, Cathie Wood, and Ray Dallo, and no doubt there are others. Facebook declined to remove the ads. They agreed not to show me the ads, though they didn't exactly keep that promise, either, hence my ability to collect so many of them.

Facebook's parent company, Meta Platforms Inc., owns WhatsApp.

Many victims have also failed SEC complaints.

The Press

Pig Butchering schemes have gained local and national attention over the past several weeks.

On February 25th, Last Week Tonight with John Oliver's main segment was on Pig Butchering schemes.

On February 29th, NBC Miami ran a segment on Pig Butchering schemes, focusing on Red Sea Fortune Investment.

On March 15th, The Wall Street Journal ran a feature article on Pig Butchering schemes, including Red Sea Fortune Investment. In the aftermath of the Wall Street Journal article, Facebook appears -- at least temporarily -- to have removed the ads.

There are many more examples of recent press coverage. But unless more people are aware of what's going on, the defenses are limited.

Fortunately, I escaped... this time.

What's Next

As John Oliver reported in his piece, the best advice for anyone coming across a scam like this is to recognize it, and to stay out. I was fortunate to be sufficiently suspicious to ask a friend who recognized the symptoms. The SEC hasn't stepped in and it's not clear that they can. Facebook and other social media platforms could do more, much more. Ultimately, potential victims are presently on their own.

Comments